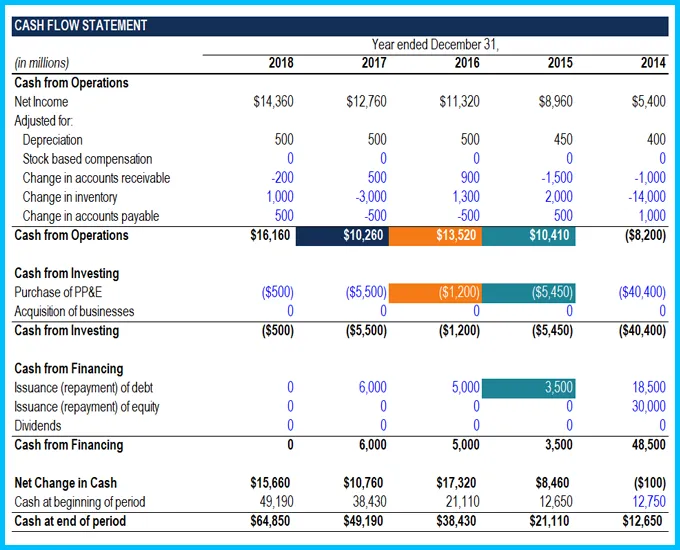

This cash flow reconciliation template will help you differentiate between EBITDA, CF, FCF, and FCFF.

There are major differences between EBITDA, Cash Flow, Free Cash Flow, and Free Cash Flow to Firm.

EBITDA can be easily calculated off the income statement by adding to the net income the taxes, interest, depreciation & amortization.

Operating Cash Flow is a measure of cash generated by a business from its normal operating activities. Like EBITDA, depreciation and amortization are added back to cash from operations. However, all other non-cash items like stock-based compensation, unrealized gains/losses, or write-downs are also added back.

Unlike EBITDA, cash from operations includes changes in net working capital items like accounts receivable, accounts payable, and inventory.

Operating cash flow does not include capital expenditures.

Free Cash Flow, also referred to as “Levered Free Cash Flow” or “Cash Flow to Equity”, can be easily derived from the statement of cash flows by taking operating cash flow and deducting capital expenditures.

FCF is the amount of cash flow available for discretionary spending by management/shareholders.

Free Cash Flow to the Firm (also called Unlevered Free Cash Flow) requires a multi-step calculation and is used in Discounted Cash Flow analysis to arrive at the Enterprise Value. It is calculated based on the assumption that the firm was to have no debt.

Credits to : Corporate Finance Institute