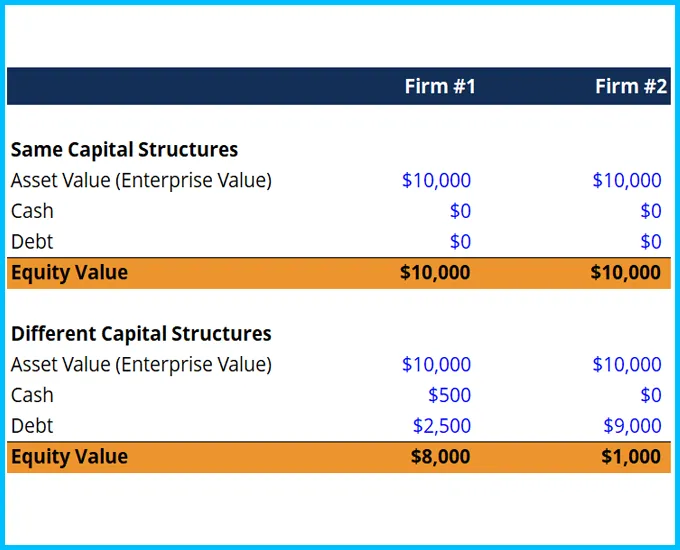

This enterprise value vs. equity value calculator will allow you to compare the equity value of two companies with the same enterprise value but different capital structures.

The enterprise value (which can also be called firm value or asset value) is the total value of the assets of the business (excluding cash). When you value a business using unlevered free cash flow in a DCF model you are calculating the firm’s enterprise value.

If equity, debt, and cash are known then you can calculate enterprise value as follows:

EV = (share price x # of shares) + total debt – cash

Where EV equals Enterprise Value.

The equity value (or net asset value) is the value that remains for the shareholders after any debts have been paid off. When you value a company using levered free cash flow in a DCF model you are determining the company’s equity value.

If enterprise value, debt, and cash are all known then you can calculate equity value as follows:

Equity value = Enterprise Value – total debt + cash or Equity value = # of shares x share price